Performance

Historically, Windsor’s and MFIP’s strategies have a low correlation to both U.S. equity and bond markets.

Past results are not necessarily indicative of future results and investors should be aware Risk can be substantial when trading futures and options on futures.

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Updated 12/6/2021 with performance data for November 2021. If you are a Qualified Investor please contact Windsor for statistics on additional strategies and fee structures.

Most Popular Strategies

Equity

Fixed Income

Strategies for Qualified Investors

Since Windsor and MFIP provide these investment strategies on a performance fee basis and/or uses simulated hypothetical (blended) historical returns, prospective clients under such contracts must meet certain regulatory standards.

Specifically, a prospective investor must have $1,000,000 or more of assets under management with Windsor after the investment in the fund or have a net worth of $2,100,000 prior to the investment in the fund (excluding the value of their primary residence).

Methodology

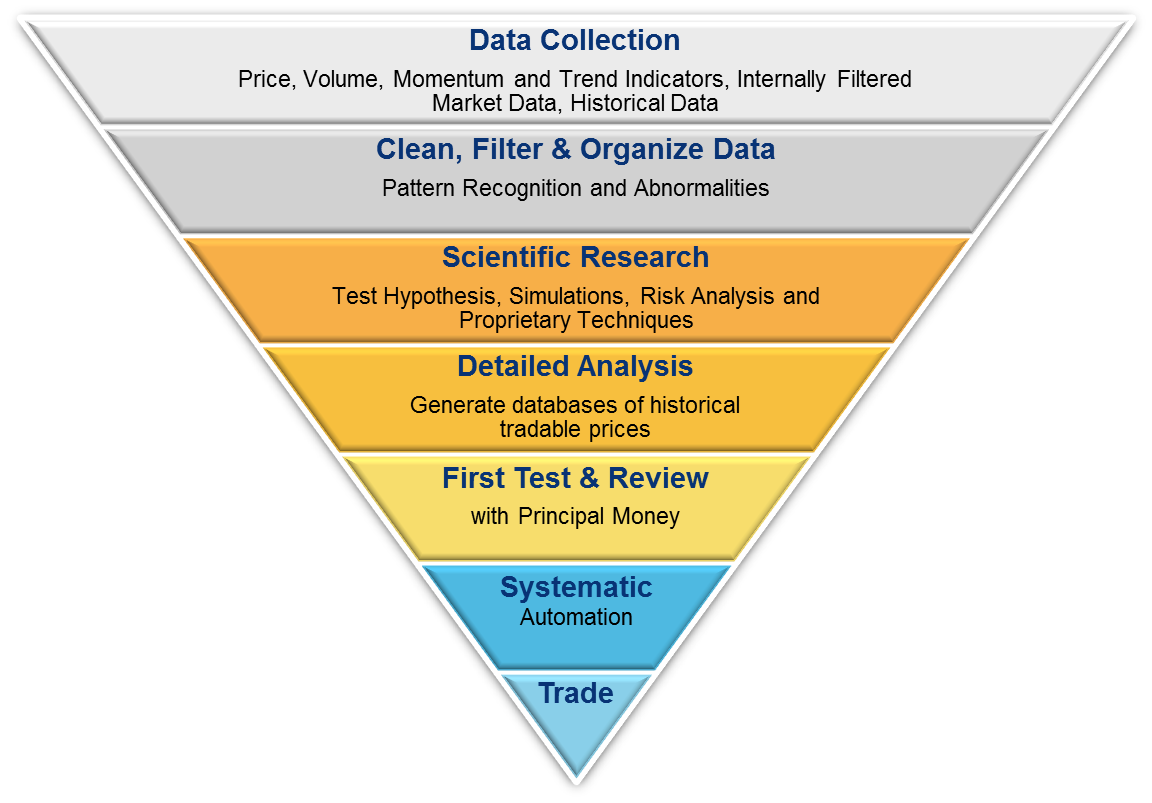

Disciplined, Repeatable, And Scalable

Customized algorithms, unique to Windsor

- Governed by hundreds of proprietary indicators and complex and robust quantitative models

- Beyond quantitative inputs, a multifaceted blend of daily and historical market data

- Signals reflect both market sentiment and momentum, and how they correlate

Tiered Approach

- Daily signal filtered through a prism of longer term signal sets, and weekly “umbrella” views

- Strategy self-scales up to beta 2, based upon buy or sell signal strength, with no application of leverage

Strategies Trade at Market Close

- Each strategy yields a signal close to market close (usually at 4:00 PM ET)

- Position remains fixed until market close the following trading day